El corazón del mundo Fintech ♥

Únete como Speaker destacado 2024

¡Descubre a los Speakers que podrás ver en nuestra 6ta edición!

¡Aplica ahora y asegura tu lugar en el escenario de la innovación!

Sé parte del cambio,

sé parte del futuro.

Revive el impacto de la 5ta edición de

Open Finance 2050

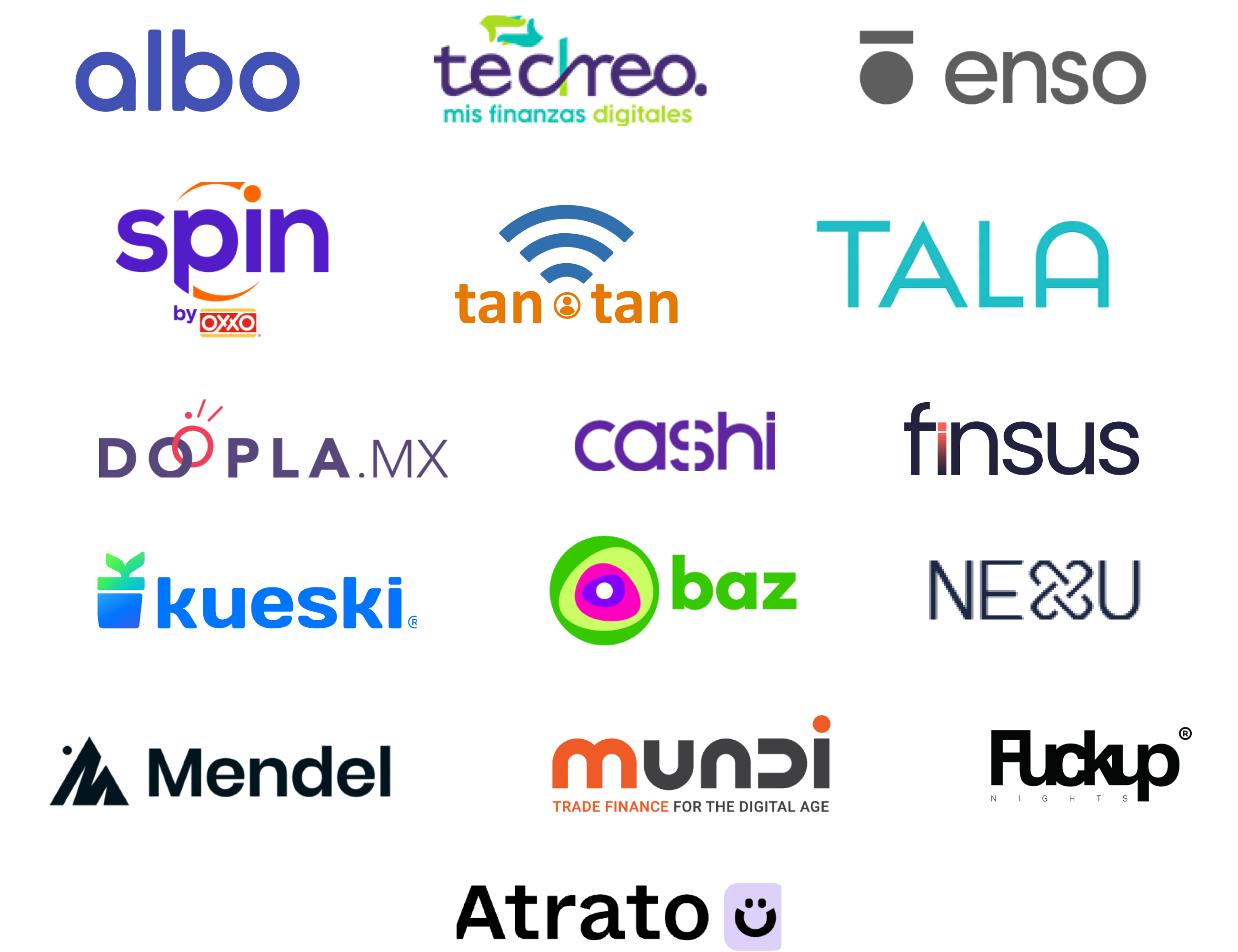

Nuestro Ecosistema Fintech

¡Conecta, colabora y triunfa en el universo fintech a través del poder del networking!

Fintech

Associations & Government

Scoring

Cibersegurity

Lending

Bigtech

Retail & eCommerce

Investors

Information Technology and Services

Banks

Unicorns

Media

Financial Services

Lawyers

Payments

%20(1).webp?alt=media&token=95a423f0-7f7c-4fc5-abf1-b5e9b13d0309)

.webp?alt=media&token=22ad0699-5e19-4c50-935e-888fb5465bcb)

Conexión & networking con +4k de usuarios.

Conexión & networking con +4k de usuarios.