El corazón del mundo Fintech ♥

Únete como Speaker destacado 2024

¡Aplica ahora y asegura tu lugar en el escenario de la innovación!

Sé parte del cambio,

sé parte del futuro.

Descubre las últimas tendencias, conecta con líderes de la industria y forma parte del cambio.

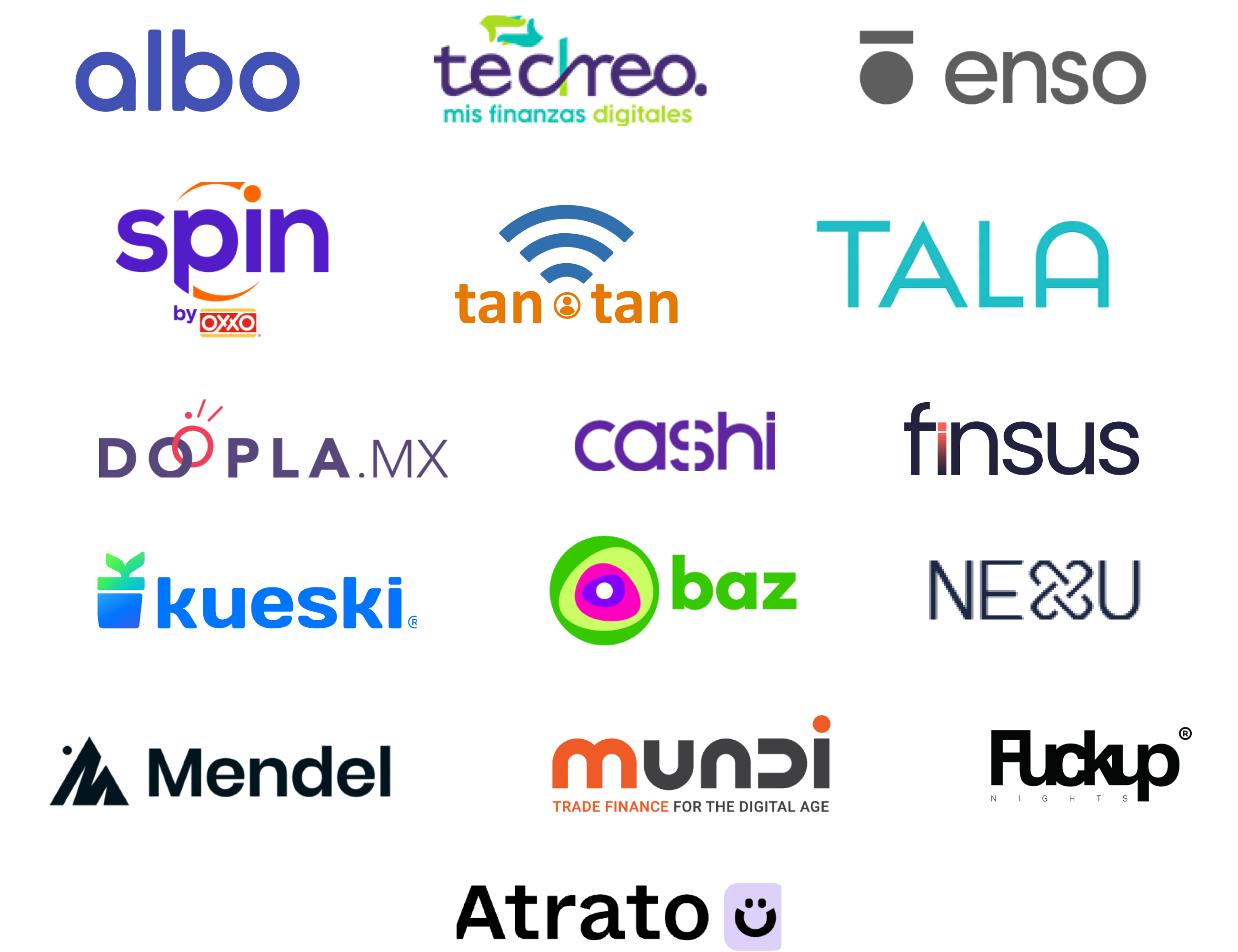

Nuestro Ecosistema Fintech

¡Conecta, colabora y triunfa en el universo fintech a través del poder del networking!

Fintech

Associations & Government

Scoring

Cibersegurity

Lending

Bigtech

Retail & eCommerce

Investors

Information Technology and Services

Banks

Unicorns

Media

Financial Services

Lawyers

Payments

%20(1).webp?alt=media&token=95a423f0-7f7c-4fc5-abf1-b5e9b13d0309)

.webp?alt=media&token=22ad0699-5e19-4c50-935e-888fb5465bcb)

Conexión & networking con +4k de usuarios.

Conexión & networking con +4k de usuarios.